Last Updated on 22/01/2026 by Damin Murdock

Claims for money had and received arise when one party seeks to recover funds paid to another without a valid legal basis. While often described as a restitutionary action, the real issue in these disputes is whether it would be unjust for the recipient to retain the money.

Australian courts approach these claims through the lens of unjust enrichment, particularly where a payment was made under a mistake or where the basis for the payment later failed.

A Leading Example: David Securities Pty Ltd v Commonwealth Bank of Australia (1992) 175 CLR 353

What Went Wrong

David Securities Pty Ltd and related companies entered into foreign currency loan arrangements with the Commonwealth Bank of Australia. As part of those arrangements, the borrowers made payments to cover what they believed was the bank’s withholding tax liability.

That belief was wrong. The payments were made under a mistaken understanding of the tax law. Once the error was identified, David Securities sought to recover the amounts paid, arguing that the bank had received money it was never legally entitled to.

The High Court’s Decision

The High Court allowed recovery. It held that payments made under a mistake of law are recoverable unless the recipient can point to a principled reason why retention of the money would be fair.

Importantly, the Court rejected the earlier distinction between mistakes of fact and mistakes of law. The focus was not on the type of mistake, but on whether retention of the money would result in unjust enrichment.

In practical terms, the bank had no contractual or legal basis to keep the funds. The payments were unnecessary, and fairness required their return.

What Courts Examine in These Claims

Disputes involving money had and received are not resolved by formula. Courts assess whether, in substance, the defendant has been unjustly enriched at the plaintiff’s expense. Key considerations include:

-

whether the defendant received a financial benefit

-

whether that benefit came at the plaintiff’s expense

-

whether the payment was made by mistake or following a failure of consideration

-

whether the defendant has a legal or equitable basis to retain the money

Where no such basis exists, restitution is generally ordered.

Why the Case Still Matters

David Securities remains foundational because it reshaped Australian restitution law. It confirmed that mistaken payments are not irretrievable simply because the mistake was legal rather than factual. It also clarified that unjust enrichment is the controlling principle, not rigid technical categories.

The case is frequently relied on in commercial disputes involving overpayments, tax errors, failed transactions, and misapplied funds.

Practical Risk Lessons

For payers, the case highlights the importance of acting promptly once a mistake is identified. Delay increases the risk that the recipient may raise defences such as change of position.

For recipients, it underscores that receiving money innocently does not guarantee entitlement. If there is no legal basis for retention, repayment may be required.

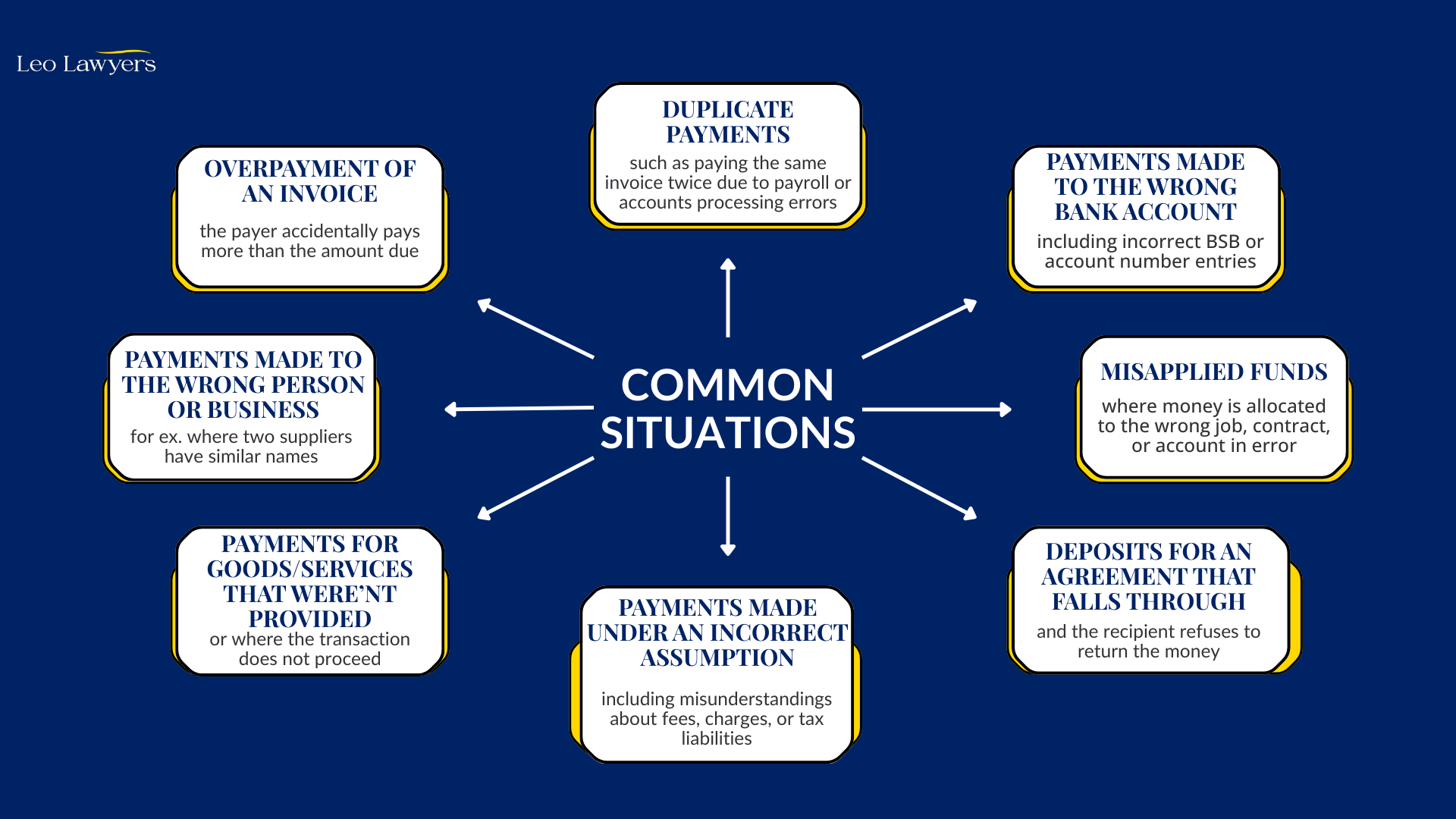

Common Situations Where “Money Had and Received” Claims Arise

Claims for money had and received commonly arise in everyday commercial and personal transactions where funds are transferred, but the recipient has no proper legal basis to keep them. In practice, these disputes often involve:

This image and its contents are protected by copyright under Australian law and international treaties. Leo Lawyers Pty Limited reserves those rights.

These situations often become disputes when the recipient refuses repayment, claims the money was owed for another reason, or argues they have already relied on the funds and cannot return them without hardship.

Key Takeaway

Money paid by mistake is generally recoverable in Australia unless the recipient can demonstrate a legitimate reason to keep it. The decisive question is not how the mistake occurred, but whether retention of the funds would be unjust.

Next Steps

If you believe you have mistakenly paid someone or if another party is unjustly holding your money, you may have a claim. Our legal team at Leo Lawyers can help you assess your situation and guide you through the process of recovering your funds.

If you are interested in discussing your options, please contact Damin Murdock at Leo Lawyers on (02) 8201 0051 or at office@leolawyers.com.au.

DISCLAIMER: This article is not to be taken as legal advice and is general in nature. If you require specific advice, please contact us.

Damin Murdock (J.D | LL.M | BACS - Finance) is a seasoned commercial lawyer with over 17 years of experience, recognised as a trusted legal advisor and courtroom advocate who has built a formidable reputation for delivering strategic legal solutions across corporate, commercial, construction, and technology law. He has held senior leadership positions, including director of a national Australian law firm, principal lawyer of MurdockCheng Legal Practice, and Chief Legal Officer of Lawpath, Australia's largest legal technology platform. Throughout his career, Damin has personally advised more than 2,000 startups and SMEs, earning over 300 five-star reviews from satisfied clients who value his clear communication, commercial pragmatism, and in-depth legal knowledge. As an established legal thought leader, he has hosted over 100 webinars and legal videos that have attracted tens of thousands of views, reinforcing his trusted authority in both legal and business communities."