Last Updated on 19/01/2026 by Damin Murdock

One of the biggest compliance risks in hospitality is underpayment of wages. With complex Award structures, penalty rates, and allowances, it is no surprise that payroll errors are common. The Fair Work Ombudsman regularly investigates hospitality businesses for underpayments, and penalties for non-compliance can be severe.

The Hospitality Industry (General) Award 2020 (the Award) sets out minimum rates of pay for all employees in the sector. Each year, these rates are updated in July following the Fair Work Commission’s Annual Wage Review. The 2025 Pay Guide reflects the latest adjustments.

Base Minimum Rates (From 1 July 2025)

According to the Fair Work Ombudsman’s Pay Guide (2025), the key minimum weekly and hourly rates are:

- Introductory Level – $922.70 per week / $24.28 per hour;

- Level 1 (Food and Beverage Attendant, Kitchen Attendant, Guest Service) – $948.00 per week / $24.95 per hour;

- Level 2 (Cook Grade 1, Doorperson, Security Officer, Guest Service Grade 2) – $982.40 per week / $25.85 per hour;

- Level 3 (Cook Grade 2, Handyperson, Storeperson, Kitchen Attendant Grade 3) – $1,014.70 per week / $26.70 per hour; and

- Level 4 (Tradesperson Cook Grade 3, F&B Attendant Grade 4, Guest Service Grade 4) – $1,068.40 per week / $28.12 per hour.

Protect Your Business With a Compliance Check today

Penalty Rates Under The Award

The Award provides generous penalty rates for work performed outside ordinary hours:

- Evenings (7pm–midnight): ordinary rate + $2.81 per hour;

- Nights (midnight–7am): ordinary rate + $4.22 per hour;

- Saturdays: 125% of ordinary rate;

- Sundays: higher penalty rates (often 150% of ordinary rate); and

- Public Holidays: 225% of ordinary rate.

For casual employees, these penalties are applied on top of the 25% casual loading.

Allowances Under the Award

Hospitality workers may also be entitled to allowances, including meal allowance when required to work overtime without notice, fork-lift allowance, supervisory allowance, and tool and equipment allowance for trades. Employers must check Schedule C of the Award to ensure these allowances are paid correctly.

Common Mistakes by Hospitality Employers

Misclassification of staff, such as placing employees at a lower level than their actual duties warrant, forgetting penalty rates particularly on weekends, public holidays, and late nights, incorrect payslips failing to itemise penalties and loadings correctly, not updating payroll annually following the July wage increase, and failing to apply allowances such as meal allowances.

Compliance Tips for Employers

- Download the updated Pay Guide from the Fair Work Ombudsman every July.

- Audit your payroll classifications against the Award.

- Cross-check payslips to ensure penalties and allowances are displayed correctly.

- Train payroll staff and managers to understand Award obligations.

- Engage external auditors periodically to verify compliance.

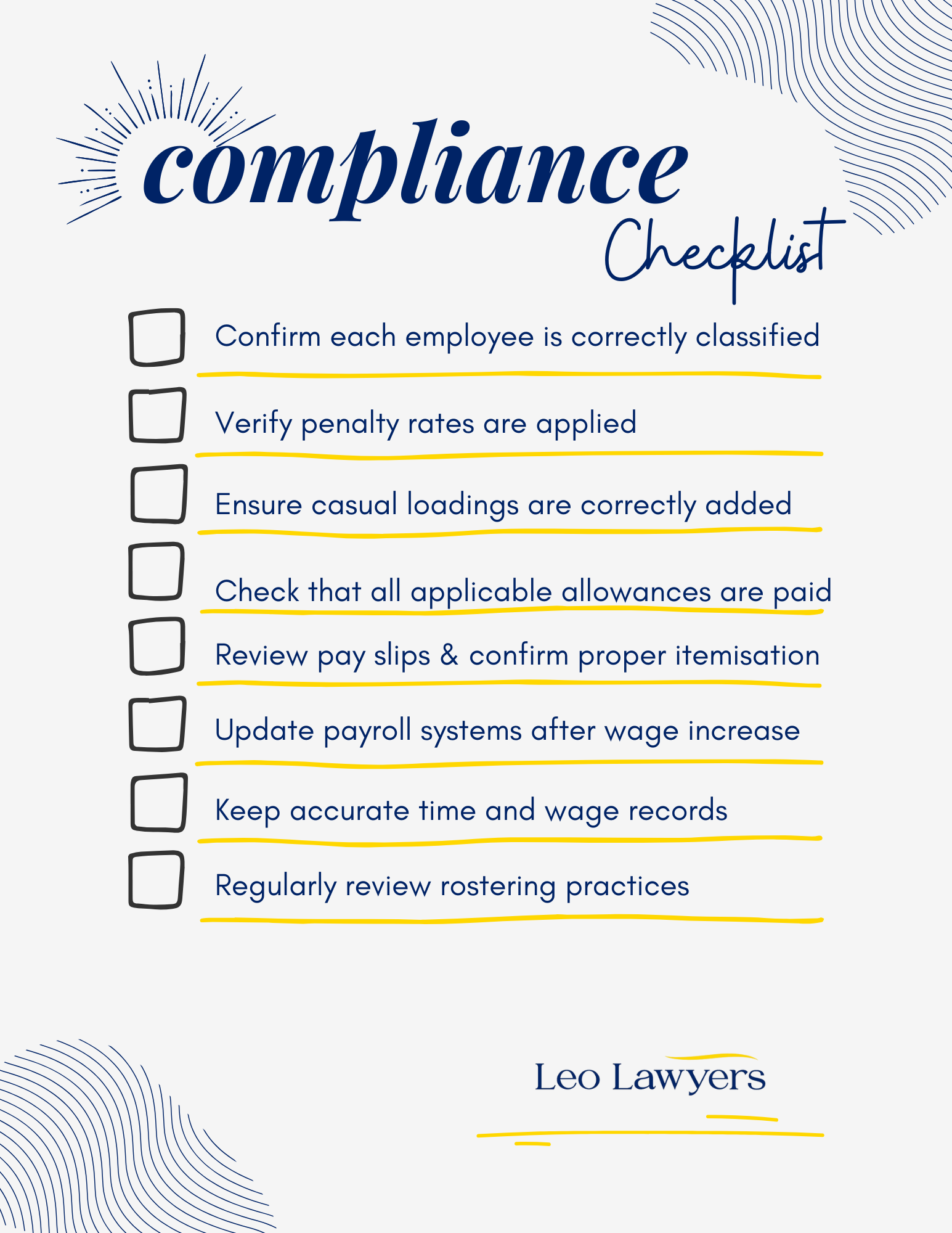

Employer Compliance Checklist

Before the Fair Work Ombudsman knocks, employers should ensure the following are in place:

This image and its contents are protected by copyright under Australian law and international treaties. Leo Lawyers Pty Limited reserves those rights.

Consequences of Underpayment

The Fair Work Ombudsman has taken enforcement action against numerous hospitality venues for wage theft. Penalties can include orders to back-pay staff, fines for breaching the Award, court-ordered penalties for serious contraventions, and reputational damage, particularly where cases attract media coverage.

A 2016 Fair Work Ombudsman investigation into the fast food industry identified widespread compliance failures, including excessive unpaid or underpaid hours and a reliance on vulnerable workers, particularly young workers, migrant workers, and workers from non-English speaking backgrounds. That investigation resulted in significant enforcement outcomes, including legal proceedings, one enforceable undertaking, compliance notices, infringement notices, and formal cautions.

Key Take Aways

Keeping up with the annual changes to minimum rates and understanding penalty rates is essential for every hospitality employer. A robust payroll system and regular audits are your best defence against costly underpayment claims.

Feel free to contact Damin Murdock at Leo Lawyers via our website, on (02) 8201 0051 or at office@leolawyers.com.au. Further, if you liked this article, please subscribe to our newsletter via our Website, and subscribe to our YouTube , LinkedIn, Facebook and Instagram. If you liked this article or video, please also give us a favourable Google Review.

DISCLAIMER: This is not legal advice and is general information only. You should not rely upon the information contained in this article and if you require specific legal advice, please contact us.

Damin Murdock (J.D | LL.M | BACS - Finance) is a seasoned commercial lawyer with over 17 years of experience, recognised as a trusted legal advisor and courtroom advocate who has built a formidable reputation for delivering strategic legal solutions across corporate, commercial, construction, and technology law. He has held senior leadership positions, including director of a national Australian law firm, principal lawyer of MurdockCheng Legal Practice, and Chief Legal Officer of Lawpath, Australia's largest legal technology platform. Throughout his career, Damin has personally advised more than 2,000 startups and SMEs, earning over 300 five-star reviews from satisfied clients who value his clear communication, commercial pragmatism, and in-depth legal knowledge. As an established legal thought leader, he has hosted over 100 webinars and legal videos that have attracted tens of thousands of views, reinforcing his trusted authority in both legal and business communities."